Evan Jiang was cautious about advertisements from the Chinese website HomeX . He had been in a WeChat group for six months where they promoted HomeX products frequently, however, it wasn’t until his MacBook Pro’s battery was broken around Thanksgiving of 2022 that he took the plunge.

He saw a great deal on a MacBook Pro 16-inch being offered by HomeX. The website advertised that customers only needed to pay 10% of the MacBook’s price, but a deposit of $7,000 was required to secure the deal. HomeX promised to refund the full deposit fee within 1 to 3 months after Jiang received the MacBook.

Jiang said his trust in the company grew gradually after he joined the WeChat group where members shared screenshots of their received products and refunds. According to Jiang, these screenshots convinced him to make his first and only purchase from the company. “Chinese community is not large, HomeX’s marketing tactics were very effective and made their products very appealing,” Jiang recalled.

Months passed and Jiang never received the refund of his deposit fees nor the MacBook. As he would soon find out, he was not the only one.

About 500 people have reported falling victim to the same scam: a Ponzi scheme carried out by HomeX that targeted Chinese immigrants with promises of high returns on investments in different products, and all operating on the messaging platform WeChat, according to Jiang.

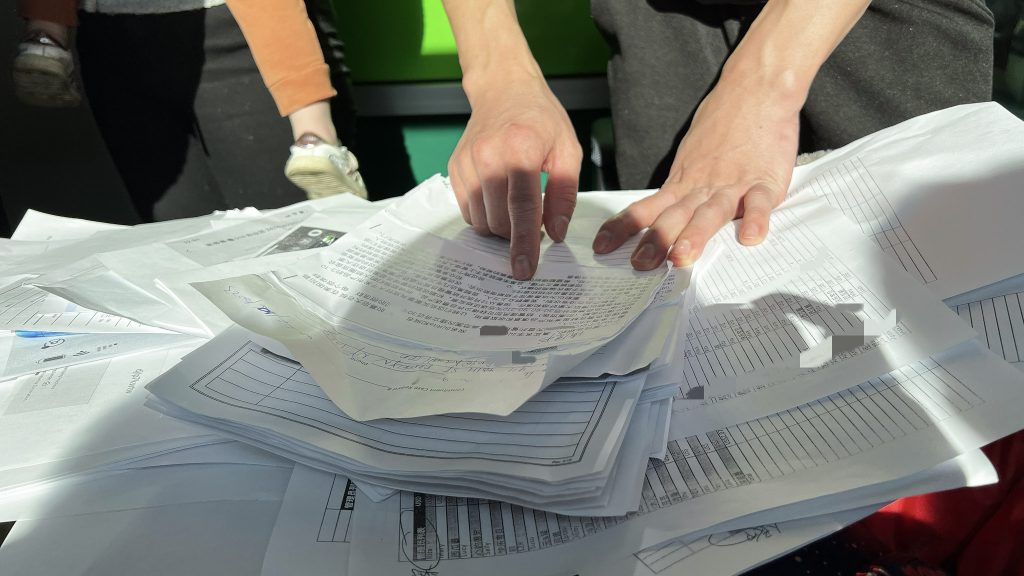

Jiang, a 38-year-old Uber driver in New York City, is one of the volunteers who helped organize a victims’ justice group and collect the complaints from the victims. As of March 6, he says victims have lost an estimated $10 million.

The group includes victims from across the United States, including New York, California, Texas, Florida, Pennsylvania, Minnesota, and other states. About 300 victims have submitted their information and documents in the New York area alone.

The victims who reported the scam are just “a tip of an iceberg,” Jiang said, as many victims may be unwilling to speak because they feel ashamed about being tricked, their immigration status, or the fear of retaliation from the scammers who have their personal information.

Jiang said the victims filed complaints to the New York Attorney General’s office on Feb. 27 and State Assemblyman Lester Chang on Feb. 10 because many families say they are in dire situations. One couple was on the verge of divorce due to their financial losses. One man was unable to work due to depression after being scammed. One person harmed themselves out of guilt. Another pregnant woman was too traumatized to file a complaint, Jiang said.

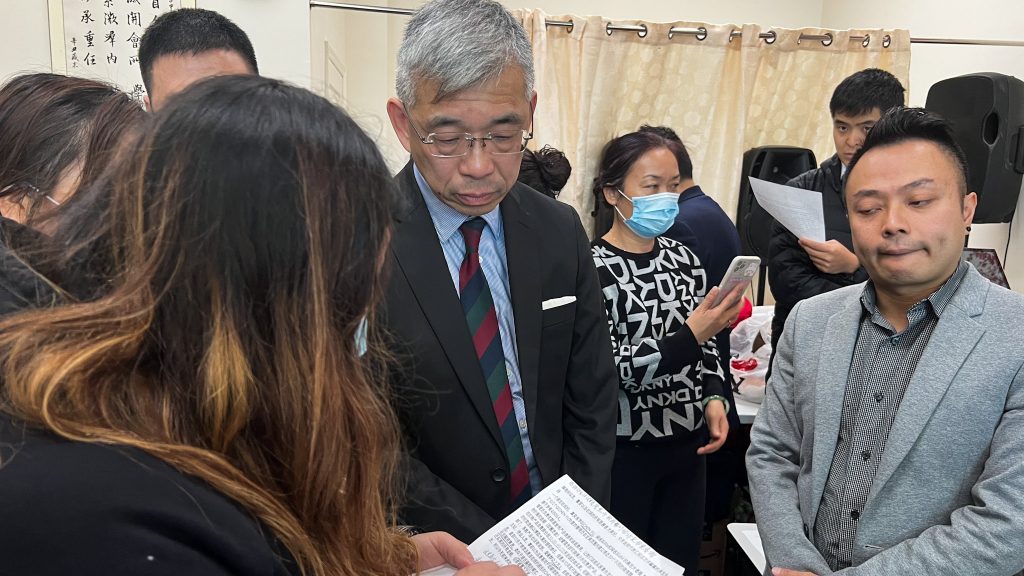

On Feb. 10, State Assemblyman Chang held a community meeting in a small office in Sunset Park, Brooklyn. Dozens of Chinese immigrants surrounded him with complaints about the scheme. Most of them were middle-aged women, some were even pregnant. One long-haired woman approached Chang with a hefty pile of documents in her hands.

“We came here today for help and hope to get assistance from you and the police,” she said, pleading with Chang in Chinese. “We have nowhere else to turn.”

The woman told Documented that she and several other Chinese immigrants were victims of HomeX’s Ponzi scheme that lost them thousands of dollars.

Because some suspects’ identity information provided by the victims is awaiting investigation by law enforcement agencies, victim names have been kept private or have been replaced with aliases.

Also read: Families Temporarily Avoid Losing Their Homes After $4 Million Housing Fraud

HomeX, an investment with a refund and free products

According to the victims’ complaint, during the pandemic a Hong Kong-based shopping company “HomeX” started promoting a high-return investment opportunity for customers who bought various products, ranging from furniture, appliances, beauty products, electronics, and children’s toys.

Through various marketing strategies, HomeX, whose website is now defunct, established over 30 chat groups on WeChat, the most popular messaging app and social media platform among Chinese people, to execute its scam. Some groups reached up to 500 members.

Unlike conventional financial scams, which promise high cash returns or other forms of currency, HomeX told buyers if they paid a deposit fee 3 to 5 times the monetary value of a purchased product, they would not only be sent the product but within 1 to 3 months, be given a refund of their deposit fee and a percentage of the product’s cost, typically ranging from 80% to 100%. The deposit fee, HomeX implied, would have a return rate that could reach 20% to 40% within those 1 to 3 months.

To gain trust, HomeX made it appear that investing in their products was a safe option. Initially, early investors were receiving their products and getting their money back. However, similar to other Ponzi schemes, HomeX relied on using the investments of new investors to pay old investors the promised return. According to the victims Documented spoke with, the administrators of their WeChat groups sometimes instructed them to pay the investments to other investors. Some thought it was the boss’s way of simplifying the payment process.

With trust established, investors increased their investment. HomeX then began lengthening the payback duration and raised the deposit fees for these products. But after multiple of these delays, investors realized their investments were gone. One victim reported buying a pool table for about $1900 with a deposit fee of $18,800. They never received the refund.

Also read: Rideshare, Delivery Workers Demand Protections from App Companies

Last carnival before the collapse

Like many victims, Yan Sun, a 33-year-old housewife living in California, was skeptical at first about the supposed investment opportunity. However, she had seen screenshots of acquaintances sharing their free products and their refunded payments that they obtained through HomeX on her WeChat Moment feed. “I wanted to join the WeChat group to observe what was going on first,” Sun said.

In the WeChat group, Sun said the group administrator “Rita” and her assistants would inundate members with “hundreds of promotional messages” on a daily basis and remove those who questioned refund delays. Members would also post screenshots with their deposit fee refunds and products, something admins required members to do in order to receive their investment back, she said.

The strategies had the dual effect of convincing more group members, including Sun, to place orders and send funds. Sun invested in around 20 products, including an iPad, a cabinet, faucets, and a toaster oven. Through HomeX, she said she lost over $45,000 — all of her savings from the past three years of the pandemic. However, despite her investment, she said she only received five products valued at about $1,000 and never received her refunds.

According to Sun, the scammers also used several tactics to delay refunds and keep victims investing. Misleading tactics included suggesting that undelivered products ordered on HomeX’s website could be exchanged for products from legitimate online shops like Amazon, BestBuy or the Apple Store. Other tactics included luring consumers to keep investing by promising a lump sum refund in the future or offering different paid membership programs to expedite the refund process.

“It’s like you mentioned your rice cooker was broken yesterday, the next day they would have a deal on rice cookers,” Fang Lin, a victim residing in New York, said.

But during last year’s holiday season, Lin said shopping enthusiasm among WeChat group members peaked before it all started to crumble like dominoes. Lin was in the WeChat group overseen by “Jun” and “Yun.” Last December, Jun and Yun abruptly disclosed in the WeChat group: “…this is a scam, the boss took the money and ran away!”

The following day, the boss, known on WeChat as “Afei,” posted a lengthy message in the group chat alleging that Jun and Yun had deceived investors’ funds. While it’s unclear if Jun and Yun and other administrators were accomplices, the news of the fraudulent investment scheme circulated rapidly throughout the various WeChat groups. Members, who were once strangers, started exchanging information, and speculations that Afei was a fake account created by one of the administrators began to emerge.

Some investors are still holding onto the hope that HomeX is a legitimate company after Afei offered a supposed “refund solution,” Lin said, who provided a screenshot to Documented where Afei asked the investors to pay a 5,000 RMB deposit, about $720, and provide their credit card information, including card numbers and security codes. The information would be used to reconcile financial transactions and ensure accuracy before the refund process, Afei had told them.

Lin warned that the proposed “solution” may be another “scam trick”, and expressed concern that investors may not receive their 5,000 RMB deposit back, and that their credit cards could be susceptible to unauthorized charges.

Also read: Troubled ASA College Closed But Left Students Out In the Cold

Up to one’s old tricks

According to David Shapiro, distinguished lecturer at John Jay College of Criminal Justice and ex-FBI special agent, the scam used by HomeX is an old trick. However, he notes these scammers are particularly effective at exploiting human vulnerabilities. For instance, people are often more willing to trust someone they believe is similar to them. Additionally, many scams possess a certain plausibility, as they often resemble legitimate business opportunities.

Shapiro identified several common red flags associated with scams, such as offers that seem too good to be true and deals that are not initiated by the individual. “I call it the Santa Claus thing,” Shapiro said. “Think, why would somebody present a wonderful financial opportunity? And of course, the answer is nobody in the right mind would do that.”

The SEC website has published several warning signs of Ponzi schemes, including promises of high returns with little or no risk, overly consistent returns, unregistered investments, secretive and complex strategies, and difficulties in receiving payments, among other things.

Shapiro said he was skeptical victims would recover their lost funds. “Here’s the thing about law enforcement in the United States. If you steal $1 off a million people, nobody cares. But if you steal a million dollars from somebody important or influential, they care.”

Shapiro suggested victims could improve their chances of recovering their funds by presenting a compelling case to law enforcement agencies to trigger an investigatory or prosecutorial action, such as the Federal Trade Commission, the New York State Department of Financial Services, and the New York State Attorney General’s Office. Reporting such crimes could lead to changes in laws and regulations, as well as alert the public about the scam. By doing so, victims can help prevent others from falling prey to similar scams.

However, some victims said they faced difficulties in filing a police report due to language barriers or inadequate knowledge about the correct procedures involved.

TestPost3

After the Feb. 10 community meeting in Sunset Park, Assemblyman Chang said he alerted the NYPD about the scam and has further plans to educate the public about this type of scam through videos. Additionally, he intends to add Chinese-language services to his website to assist Chinese victims who are not fluent in English in filing their complaints in the future.

Jiang said many victims were not living in good conditions and were looking for ways to improve their financial situation by investing in this opportunity. “We were foolish and we learned the lessons, but we want people to understand that we fell for the scam not just out of greed, but also because of the pressure we were under. Now we just want the criminals to be held accountable and justice to be served.”

A New York Attorney General’s office spokesperson encourages any New Yorker who believes they have been a victim of this scheme to report it to the AG office by filing a complaint online or calling its helpline at 1-800-771-7755. The helpline has translation services available in various languages and dialects.

Documented attempted to contact the administrators named “Rita,” “Mary,” and “Jun” using the phone numbers provided by the victims. None of the administrators responded to the calls or text messages as of the time of publication. The FBI and NYPD did not reply to Documented’s requests about the fraud.